Streamline Collections with Automated Recurring Payments

Diversify Payment Options for Seamless Recurring Payments and Subscription Management

Tailor Payment Modes to Suit Every Customer's Needs

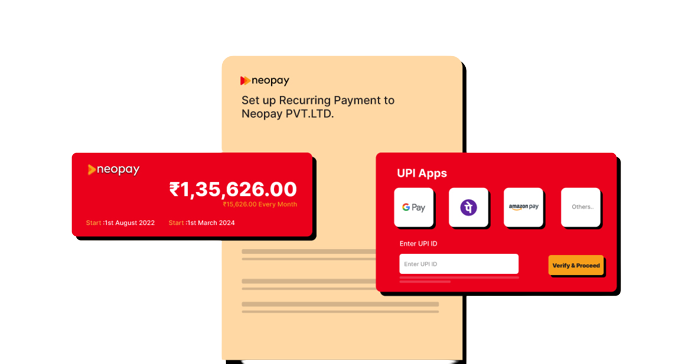

UPI AutoPay

Instantly collect recurring payments of up to ₹15,000 through UPI AutoPay. Onboard your customers or borrowers in just 30 seconds. Boost revenue retention with a 30% increase in successful mandate creation.

e-NACH

Empower same-day mandate creation for amounts up to ₹10 Lakhs with e-NACH or e-Mandate. Ensure a swifter, enhanced checkout experience for your customers through net banking or debit card-based authentication.

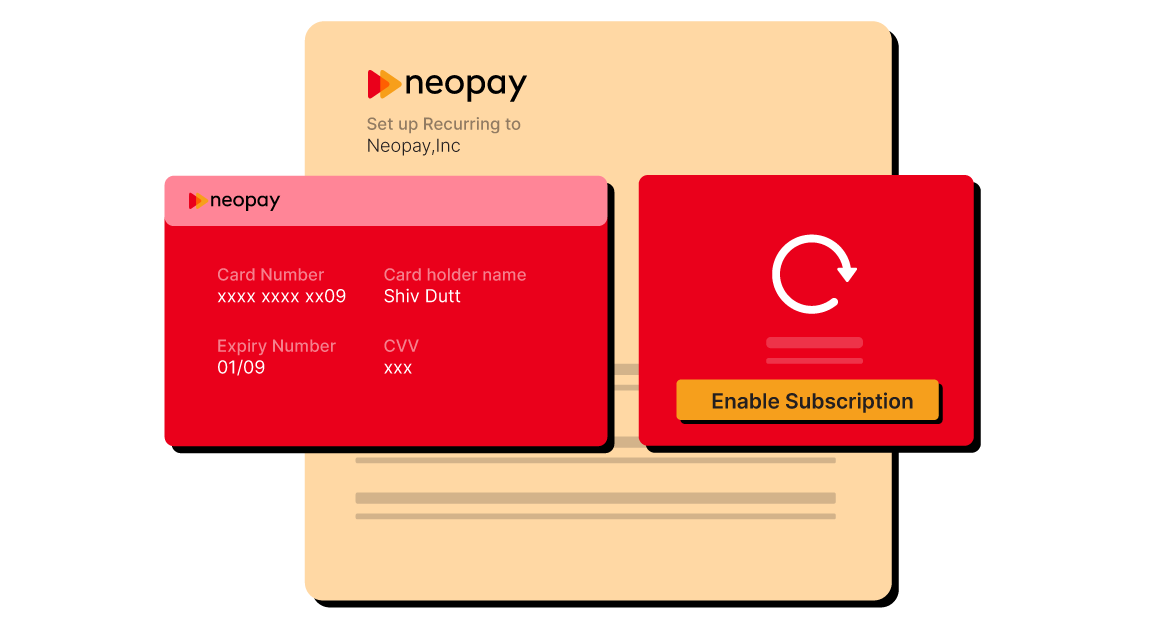

Cards

Tap into a vast market of 90+ crore debit card and credit card users in India by facilitating recurring payment setup.

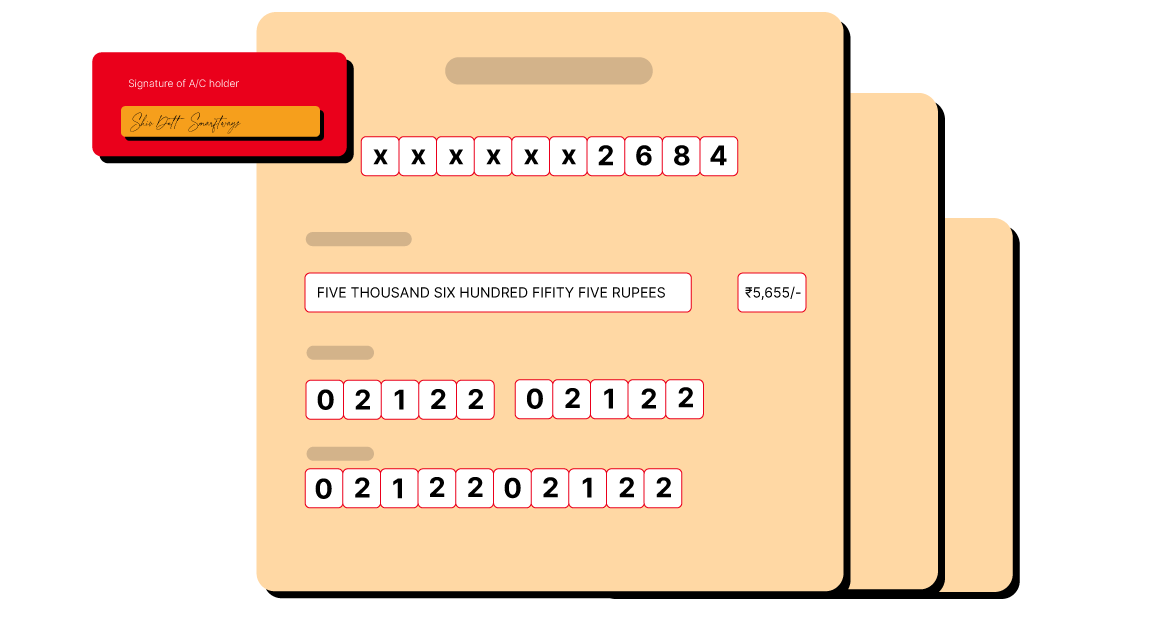

Physical NACH

Provide convenient auto-debit for customers without digital banking access. Set up straightforward loan recollection with a one-time signature approval via Physical NACH from borrowers.

Streamline compliance with our comprehensive digital lending solution.

NBFCs and Fintechs choose Neopay for compliant collections, credit disbursement, and co-lending, in alignment with RBI’s Digital Lending Guidelines.

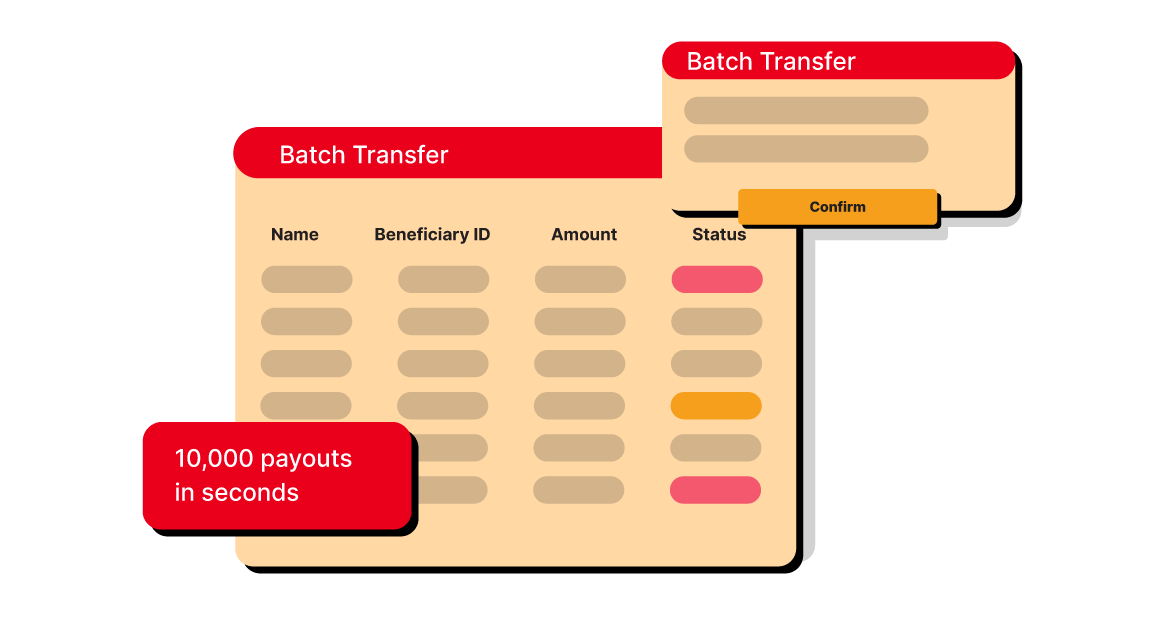

- Collect repayments with ease across methods

- Disburse loans from multiple accounts

- Secure yourself from fraud with account verification

What Makes Neopay Recurring Payments Suite the Ideal Choice?

Discover the Comprehensive Advantages and Features of the Neopay Recurring Payments Suite.

Diversify Your Payment Options

Empower Your Customers to Subscribe with Convenience: Credit Card, Debit Card, UPI AutoPay, and e-NACH Options Available

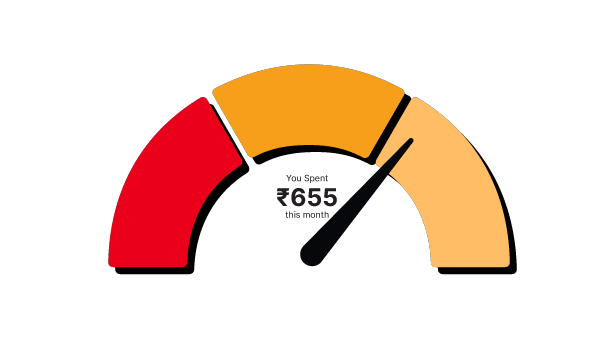

Access Comprehensive Dashboard and Analytics

Gain Insights into New Subscriptions, Cancellations, and Transaction Status via APIs or the Dashboard

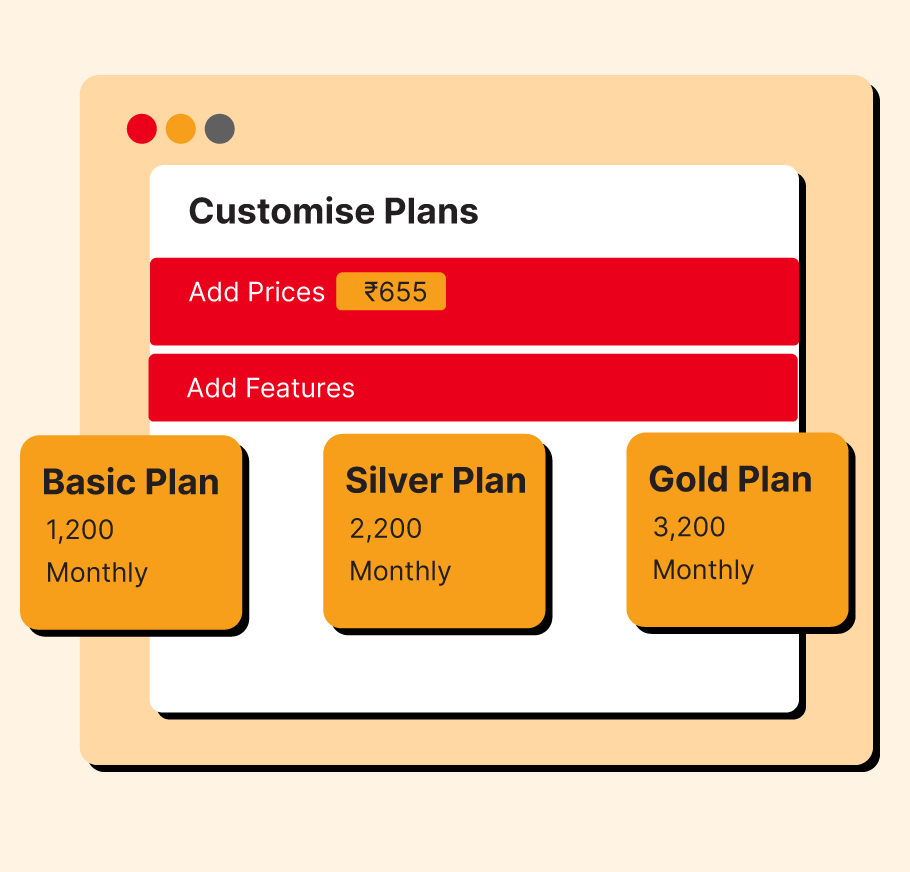

Tailor-Made Subscription Plans Just for You

Take Full Control of Billing: Customize Pricing, Plans, and Periodicity as Per Your Preferences

Fostering Growth for All Subscription-Based Businesses

Simplify processes, accelerate growth, and thrive in the subscription economy with our solutions.

OTT and Edtech

Deliver the finest, tailor-made checkout experience for acquiring and retaining a larger customer base.

BFSI

Drive growth and minimize inconsistencies, whether it’s SIPs or premium collections, through NACH-based mandates.

SaaS

Collect periodic customer payments automatically without multiple follow-ups and manual reconciliations

Frequently Asked Questions

A subscription model is employed when customers make recurring payments for uninterrupted access to a product or service. You can establish a plan for the specified duration, employing the appropriate charge model for each customer, and automate debits. Following the initial checkout, customers don’t need to manually handle payments.

Recurring payments, a payment model, involve customers granting merchants the authority to automatically deduct payments from their accounts for ongoing product or service usage. Customers only need to provide one-time approval for the merchant to initiate direct debits. The payment cycle persists until the customer revokes the merchant’s authorization or the subscription naturally expires.

These payments can be deducted either at fixed intervals with a consistent amount or on-demand, which varies based on invoices generated by the merchant. Recurring payments are particularly well-suited for scenarios involving repeat purchases or frequency-based transactions.

Credit cards issued by well-known card networks such as MasterCard and Visa facilitate the automatic deduction of recurring payments. To enable this, the cardholder must grant authorization to the designated merchant, a process that can be completed through standard Two-Factor Authentication or the 3D Secure verification flow.

Yes, you have the option to cancel a plan or subscription. However, it’s important to note that once a plan or subscription is canceled, it cannot be reinstated. To continue, you would need to create a new plan or subscription.

Yes, you can use Neopay’s recurring payments solution for your subscription management model with one subscription–multiple users.